Short Term Rental Property Manager vs. Co-Host – 5 Key Differences

Navigating the short term rental (STR) world can be intimidating at first. It’s almost like there’s a different language being used in Facebook message boards and STR podcasts. Some terms may appear to be used interchangeably (even when there are pretty major differences) and can confuse an STR owner looking for some help on their property or an aspiring entrepreneur wanting to break into the industry looking to scale faster than they can purchase properties.

One of the toughest for a newcomer to wrap their head around is the difference between a short term rental property manager and a Co-Host.

A property manager is a company that is responsible for all aspects of a rental property. That’s why this is often referred to as full service. They collect funds from guests, disburse payments to owners, manage cleaners, coordinate repairs, and handle all guest communications.

A Co-Host is a decidedly STR term, originally created by Airbnb, and defined as someone who “helps” Airbnb owners take care of their rental property and guests. Because of this, there are a lot of differences between what one person might offer as a Co-Host vs. what another person might offer.

5 Key Differences

Here are the 5 key differences between a STR property manager and a Co-Host:

- Licensing

- Property Manager– most states have laws and requirements for who can become a property manager. These can be found online – here’s a good starting point. What gets murky is whether short term rentals fall into the same category as traditional property management. Some states tend to treat vacation rentals similar to hotels, where no license is needed. So, all we’ll say here is – be safe and do your research! And if you’re looking to hire a property manager – ask whether they are licensed!

- Co-Host– there are no licensing requirements for a Co-Host designation as they are not collecting funds. Although again – do your own research!

- Flow of Guest Funds

- Property Manager– collects funds from all guests regardless of the booking channel. Funds are held in a bank account designated as the trust account (also called escrow) and at the end of each month, disbursements are made to the owners and to the management company’s operating account.

- Co-Host– doesn’t collect funds from guests. May collect funds from Airbnb if the Co-Host feature is used to split payments, although that can get messy if there are multiple booking channels to track.

- Listing Control

- Property Manager– typically owns the listing for each channel. For instance, in Airbnb, the listing would be found under their account.

- Co-Host– typically controlled by the homeowner, with the Co-Host being added to the account either as a Co-Host (in Airbnb) or shared login credentials.

- Maintenance & Supplies

- Property Manager– provides supplies for the property (can be charged to the owner depending on the fee structure) and coordinates and pays for light maintenance & repairs.

- Co-Host– varies depending on the agreement. Some will pay for all supplies & maintenance and then invoice the owners. Others will pay for them with the owner's credit card, while other times the owner will handle those items directly.

- Occupancy Taxes

- Property Manager– any occupancy taxes not collected & filed by OTA’s like Airbnb are typically filed by the property manager on behalf of the owner. Some property managers handle it themselves, while others will outsource it to a third party like Keystone Bookkeepers or Avalara. Filings may be monthly, quarterly, or even annually.

- Co-Host– since funds are passed on to the owner, the owner is also collecting and responsible for paying property taxes. Co-Hosts may help provide reporting to aid the owner in filing the taxes.

One Bonus Difference - Owner Statements!

Since the flow of funds is different, it stands to reason the owner’s statements would be different as well. While statements will vary from manager to manager, a good owner statement will have each stay broken out individually with the different revenue components to make the relationship as transparent as possible.

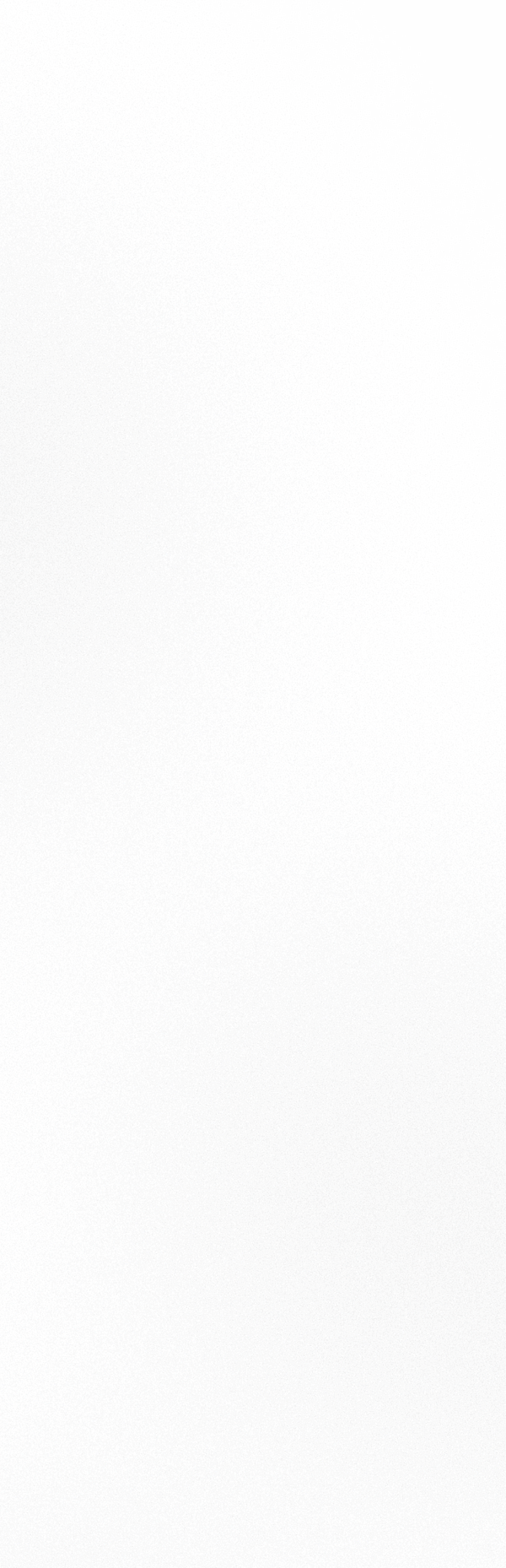

Below is an example of a Property Management statement where funds are collected by the property manager and disbursed to the owner monthly. We’re just focusing on revenue for this example, but based on this statement, funds owed to the owner would be $16,035.36.

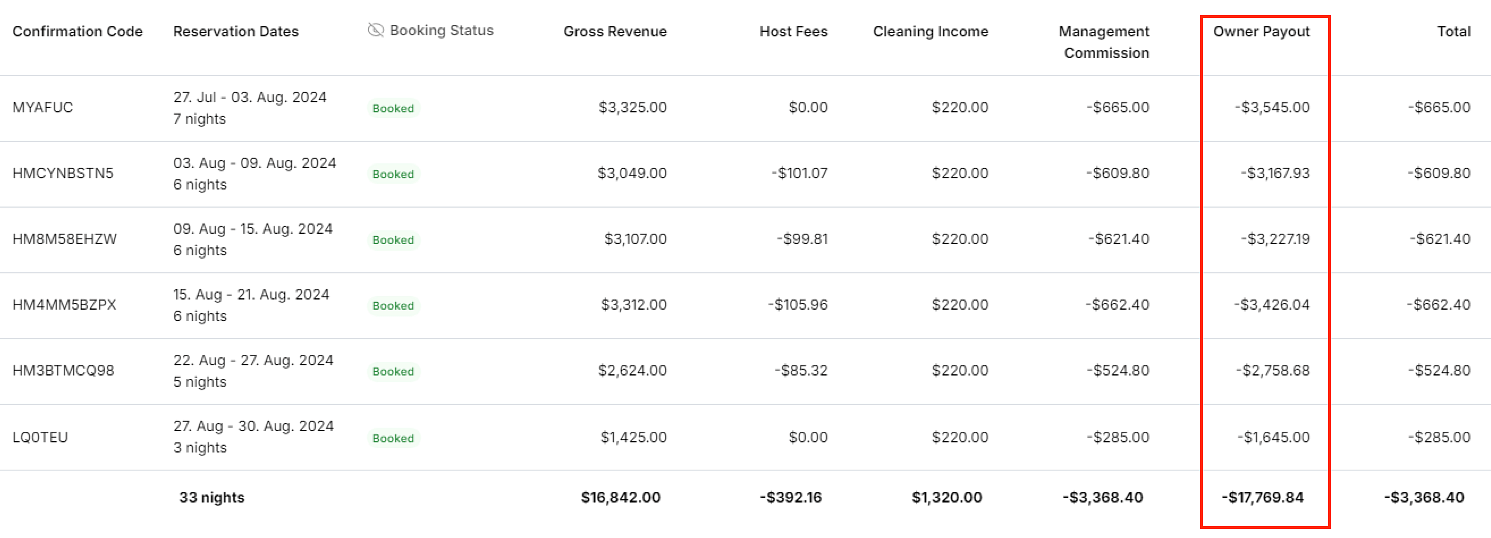

A statement from a Co-Host will have one key difference – an owner payout. This is because we need to reflect the funds already paid to the owner, in essence, turning the statement into an invoice.

Here you can see that we have an Owner Payout column. We can still show the owner how the property performed and what reservations came through, and if you’ll notice, the total owed ($3,368.40) is the same as the Management Commission column. This is the amount that would be invoiced to the homeowner to pay to the Co-Host.

The rest of the statement is typically very similar, depending on who pays for expenses, but adding the Owner Payout to the statement is a key difference for STR Co-Hosts.

Whether you are a property manager, Co-Host, or investor with a vacation rental portfolio, Keystone can provide tailored bookkeeping services for your business. If you have any questions or want to learn more about our services, please contact us today!